Our Events

See archive »News

2 September 2025

International Online Conference (November 27, 2025)10 February 2025

International Online Conference (June 5, 2025)22 February 2024

International Online Conference (June 6, 2024)Essential tips for negotiating exclusivity in a small business M&A transaction

After putting your blood, sweat and tears into building a profitable and growing enterprise, there may come a time when potential buyers come knocking at your door. Realizing that your business is an attractive acquisition target can be both exciting and intimidating, and you should take the time to understand what to expect and how to negotiate towards the best possible deal.

One of the key issues that you will encounter when negotiating with a potential buyer is exclusivity. In a typical exclusivity agreement, the seller agrees not to negotiate with any other potential buyers for a specified period of time. Many buyers ask for exclusivity in order to: (1) ensure that the time and expense of conducting due diligence and negotiating with the seller is worthwhile, (2) avoid the pressure of competing offers and (3) provide time to obtain financing for the acquisition. While sellers typically resist granting exclusivity if possible, a well drafted exclusivity agreement can benefit the seller by incentivizing the buyer to complete its due diligence, obtain financing and legally commit to the acquisition in a timely fashion. If you find yourself negotiating an exclusivity arrangement with a potential buyer, keep the following considerations in mind:

When and How To Grant Exclusivity

Granting exclusivity to a potential buyer will prevent the seller from negotiating with other interested parties. Thus, a seller should only grant exclusivity after the buyer has made a meaningful commitment to the principle terms of the transaction, including a reasonable price range for the business. Often, these principle terms are embodied in a term sheet or letter of intent. Either of these documents could include an exclusivity provision, or exclusivity could be embodied a stand-alone agreement. Exclusivity agreements, like confidentiality agreements or term sheets, are preliminary agreements and are entered into prior to the signing of the primary acquisition agreement.

The "No Shop" Provision

The core provision of any exclusivity agreement is the “no shop” provision. Generally, a “no shop” provision prevents the seller from soliciting, negotiating or entering into agreements to sell the business to other potential buyers (typically called “alternative transactions”). A buyer often wishes to also include terms requiring the seller to end any open discussions with other buyers and to notify the buyer of any unsolicited offers from potential buyers during the exclusivity period.

Exclusivity Period

An exclusivity period typically begins when the buyer makes a meaningful indication of interest (e.g. in a term sheet or letter of intent) and ends when the buyer and seller sign an acquisition agreement. Buyers tend to push for longer exclusivity periods like 30 – 60 days. However, with the exception of an extremely complicated transaction, a seller should try to limit the exclusivity period to 7 – 14 days. This should allow a reasonable time for the Buyer to conduct due diligence and obtain financing while still providing a healthy pressure on the Buyer to legally commit to the transaction. If you do have to agree to a longer exclusivity period as a seller, you may be able to negotiate an exclusivity fee from the buyer in return.

Even if everything goes well, the buyer and seller may need more time to finalize the transaction. In such a case, the agreement should allow the exclusivity period to be extended as needed.

It is important to note that the type of preliminary exclusivity agreement discussed in this post does not cover the period between signing of the primary acquisition agreement and closing of the transaction. In many acquisitions, the period between signing and closing could be weeks or even months. In order to preserve exclusivity during this time, a separate no shop provision should be added to the acquisition agreement itself.

Termination

As a seller, you’ll want to make sure that you can terminate the exclusivity period if the buyer is offering terms that are materially worse than those outlined in the term sheet or if you believe that the buyer isn’t making enough progress in finalizing the deal. This will help protect you from getting stuck in an exclusive arrangement with a buyer who has either lost interest or refuses to offer reasonable terms.

In some cases, the seller’s board of directors may actually have a fiduciary duty to consider other offers. To allow for these types of situations, sellers sometimes negotiate an exception to the exclusivity requirement called “fiduciary out.” Buyers are often entitled to a fee (called a “breakup fee”) if the board exercises its fiduciary out and decides that it must consider another offer during the exclusivity period.

Good Faith Negotiation

It wouldn’t make sense to have an exclusivity agreement if the parties were not committed to closing a deal. Because of this, most exclusivity agreements include a covenant to negotiate in good faith. Such a covenant can protect the seller against certain bad behavior by the buyer, including the buyer’s waiting out the exclusivity period without negotiating or ignoring previously agreed terms.

Exclusivity Fees

Typically, exclusivity is granted by the seller in consideration of the buyer’s time and expense involved in the transaction. However, when exclusivity periods are especially long, the seller may charge an exclusivity fee. If the buyer never signs a deal, the seller keeps the exclusivity fee. If the buyer signs a deal, the exclusivity fee goes towards the purchase price of the business.

Negotiation Checklist

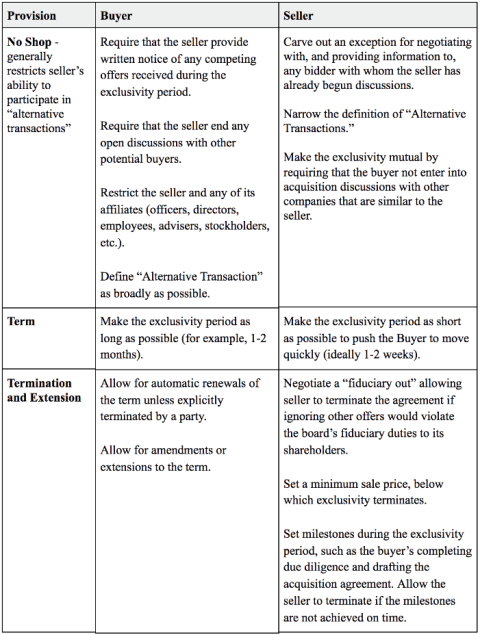

Negotiating an exclusivity agreement can be complicated. However, if armed with a basic knowledge of the relevant considerations, you can avoid major pitfalls and communicate more productively with your legal counsel. Below is a table summarizing the buyer’s and seller’s negotiating positions for certain key provisions in a typical exclusivity agreement.

Written by Andrea Lee